41 present value of zero coupon bond calculator

How to Invest in Bonds - The Motley Fool There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year ... India Treasury Bills (over 31 days) | Moody's Analytics - economy.com Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-.

Packages Overview | JuliaActuary A collection of common functions/manipulations used in Actuarial Calculations. Quickstart cfs = [ 5, 5, 105 ] times = [ 1, 2, 3 ] discount_rate = 0.03 present_value (discount_rate, cfs, times) # 105.65 duration (Macaulay (), discount_rate, cfs, times) # 2.86 duration (discount_rate, cfs, times) # 2.78 convexity (discount_rate, cfs, times) # 10.62

Present value of zero coupon bond calculator

[100% Off] Accounting-Bonds Payable, Notes Payable, Liabilities We will calculate present values using formulas and algebra, using present value tables, and using Microsoft Excel functions. We will calculate the issue price of bonds and discuss why the issue price often differs from the par value or face amount of a bond. Tata Short Term Bond Direct Plan-Growth - ET Money NAV or Net Asset Value is the per-unit price of the Mutual Fund. The NAV of a Mutual Fund changes every day. It is calculated by taking the current value of the holdings of the fund at end of the day, subtracting the expenses, and dividing the value by the number of units issued to date. The NAV of Tata Short-term Bond Fund for Sep 09, 2022 is ... Current US Yield Curve Today (Yield Curve Charts)| GuruFocus The U.S. Treasury Department issues bonds with maturities ranging from one month to 30 years. As bonds with longer maturities usually carry higher risk, such bonds have higher yields than do bonds with shorter maturities. Due to this, a normal yield curve reflects increasing bond yields as maturity increases. Figure 1 shows a normal yield curve.

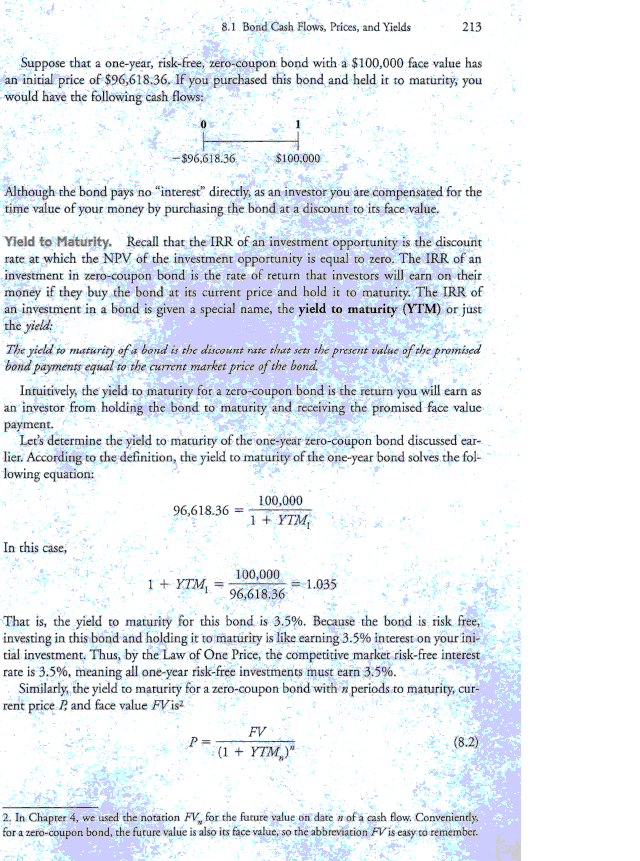

Present value of zero coupon bond calculator. What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000.... FRB H15: Data Download Program - Choose - Federal Reserve Download file. Select a preformatted data package. Treasury Constant Maturities [csv, All Observations, 914.7 KB ] Weekly Averages (Fed Funds, Prime and Discount rates) [csv, Last 52 Obs, 1.9 KB ] Weekly Averages [csv, Last 52 Obs, 11.9 KB ] Monthly Averages [csv, Last 12 Obs, 6.6 KB ] Download all H15 data as a single XML file [SDMX/ZIP, 4.0 MB] FAQ - cbe.org.eg Treasury Auctions T-Bonds. EGP T-Bonds; EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; ... the bond will pay 5 pounds coupon plus 100 pounds the face value of the bond. 3rd Row: Present Value PV(CFt) the value of the coupons and principle that will be paid in the Future as of Today. ... So Present value for ... › financial › npv-calculatorNet Present Value Calculator - CalculateStuff.com Once we calculate the present value of each cash flow, we can simply sum them, since each cash flow is time-adjusted to the present day. Once we sum our cash flows, we get the NPV of the project. In this case, our net present value is positive, meaning that the project is a worthwhile endeavor.

iShares® iBonds® Dec 2032 Term Treasury ETF | IBTM - BlackRock Get exposure to a portfolio of U.S. Treasury bonds maturing between January 1, 2032 and December 15, 2032 through a single ticker. 2. Designed to mature like a bond, trade like a stock. Combine the defined maturity and regular income distribution characteristics of a bond with the transparency and tradability of a stock. 3. ICE BofA US High Yield Index Effective Yield - St. Louis Fed Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ... Treasury Rates, Interest Rates, Yields - Barchart.com Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least risky investment available to U.S. investors. Treasury notes (or T-Notes) mature in one to ten years, have a coupon payment every six months, and ... stablebread.com › calculators › present-valuePresent Value Annuity Factor (PVAF) Calculator | StableBread Zero Coupon Bond Value Calculator; Debt and Loans. After-Tax Cost of Debt Calculator; ... Calculator; Present Value of Annuity Continuous Compounding (PVACC) Calculator;

Botswana Government Bonds - Yields Curve The Botswana 10Y Government Bond has an estimated 6.747% yield. Its value is not derived from the market, but it's calculated according to the yields of other available durations. Central Bank Rate is 2.65% (last modification in August 2022). The Botswana credit rating is BBB+, according to Standard & Poor's agency. 2 Year Treasury Note Rate Constant Maturity - Bankrate Two-Year Treasury Constant Maturity. 3.50. 3.25. 0.22. What it means: An index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to ... United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 3.102% yield. 10 Years vs 2 Years bond spread is 4.3 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. › calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Conversely, if the bond price were to shoot up to $1,250, its yield would decrease to 8% ($100 / $1,250), but again, you would still receive the same $50 semi-annual coupon payments. This is...

Live India Debt Clock Reflects Surge in Debt-to-GDP Ratio Due to Covid ... Zero-Coupon Bonds - Pay no interest but are sold at a discount and redeemed at full face value. Capital-Indexed Bonds - The face value of the bond increases in line with inflation. Inflation-Indexed Bonds - Both the loan amount and the interest are index-linked (since 2013 these bonds have been issued exclusively to the general public).

› terms › pWhat Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Discount bond calculator - JackyLucus The sum of the present value of coupon payments and principal is the market price of the bond. And the coupon for Bond A is. The n is the number of years it takes from the. Determine the years to maturity. This is due to the coupon rates and risks associated with the bond. This makes calculating the yield to maturity of a zero coupon bond ...

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve.

Tax Free Bond - REC Limited Committees of the Board. Bond Information. 54 EC Capital Gain Tax Exemption. Foreign Currency Bonds. Post-issuance certification from Climate Bond Initiative, London. REC Green Bond Framework. Certificate from Climate Bond Initiative, London. Annual Update Report for Green Bonds as on March 31, 2021. Tax Free Bond.

JOHNSON & JOHNSONLS-NOTES 2007(07/24) Bond - Insider The Johnson & Johnson-Bond has a maturity date of 11/6/2024 and offers a coupon of 5.5000%. The payment of the coupon will take place 1.0 times per Year on the 06.11..

Methods Of Estimating Value | Seeking Alpha If I offer you double or nothing on a coin flip for $1,000, the value of the bet is not $2,000 just because you won. And the value of the bet was not $0 if you lost the bet. Based on probabilities...

Treasury Bills | Constant Maturity Index Rate Yield Bonds ... - Bankrate Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Daily Treasury Yield Curve Rates - YCharts Japan Government Bonds Interest Rates: Sep 11 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Sep 11 2022, 19:50 EDT: Euro Short-Term Rate: Sep 12 2022, 02:00 EDT: Spain Interest Rates: Sep 12 2022, 04:00 EDT: European Long Term Interest Rates: Sep 12 2022, 04:00 EDT: Secured Overnight Financing Rate Data: Sep 12 2022, 08:00 EDT: Bank of ...

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Should You Invest In I Bonds? | Seeking Alpha Paper bonds - now available only as part of your tax refund - can be bought at price intervals from $50 to $10,000 while electronic bonds may be bought in penny increments starting at $25. You...

Loan Balance Calculator - TheMoneyCalculator.com Using our Loan Balance Calculator is really simple and will immediately show you the remaining balance on any loan details you enter. To use it, all you need to do is: Enter the original Loan amount (the full amount when the loan was taken out) Enter the monthly payment you make Enter the annual interest rate

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Current Rates | Edward Jones 4.50%. $10,000,000 and over. 4.25%. Rates effective as of July 28, 2022 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate. Our Personal Line of Credit is a margin loan and is available only on certain types of accounts.

Have any questions: +1 (518) 425-9303 - gradesxpress.com The bonds have 15 years left until maturity, 7% annual coupons with semiannual payments and the bonds can be called at a 10% premium, that is, the call price is $1,100. What market conditions would induce you to call the bonds? f. Think about the decision to call a bond from the perspective of the person (investor) who has purchased the bond.

Post a Comment for "41 present value of zero coupon bond calculator"