39 zero coupon bonds risk

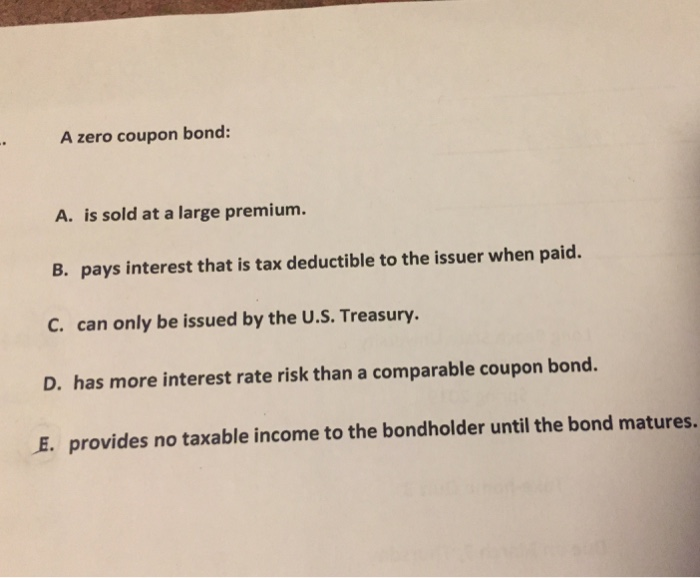

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds are also subject to all of the other baseline bond risks, including interest rate risk, default risk, and inflation risks. As we'll discuss below, some of these risks are ... Zero-Coupon Bonds: Pros and Cons - Management Study Guide No Reinvestment Risk: Zero-coupon bonds do not have any reinvestment risk. This is because the bond does not pay interest periodically. Hence, investors do not receive any cash flow which they have to reinvest periodically. The annualized rate which they receive on the zero-coupon bond is the same rate at which their money will be automatically ...

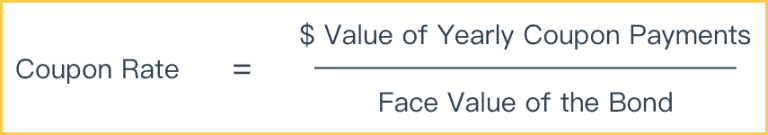

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

Zero coupon bonds risk

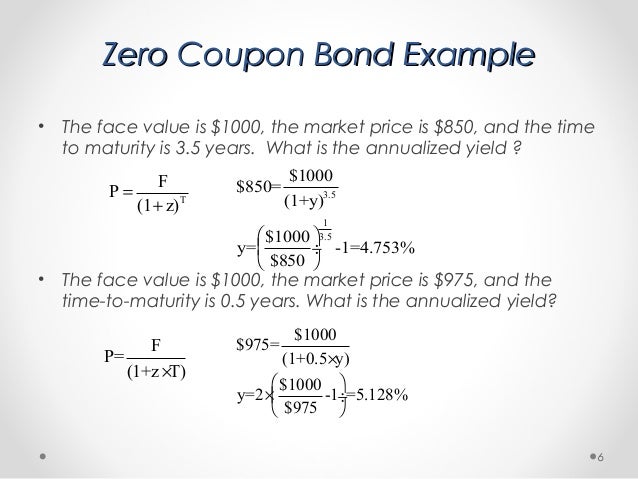

The Allure Of Zero Coupon Municipal Bonds: A Low Risk Investment With ... The La Mesa bond is a zero coupon bond that pays no coupon i.e. no income each year. In exchange, you can buy one La Mesa bond for only $73.573, a $26.427 discount to par value. When it matures on 8/1/2026, you get $100 for each share you buy, which comes out to a yield to maturity of 3.2%. Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Since a zero-coupon bond does not have this risk, the YTM will differ accordingly. What Is Yield to Maturity? YTM is the total return a bond investor will expect if it is held to maturity.

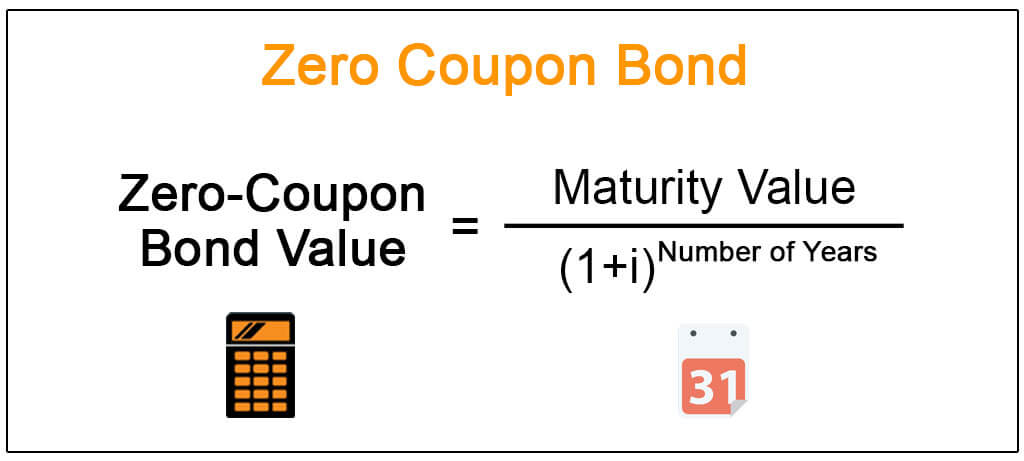

Zero coupon bonds risk. Advantages and Risks of Zero Coupon Treasury Bonds Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ... Testing Merton's Model for Credit Spreads on Zero-Coupon Bonds (0) The approach has several other features of particular relevance for risk managers, such as the exploration of scale and symmetry of shocks, and the effect of non-normality on credit risk. We show that the effects of such shocks on losses are asymmetric and non-proportional, reflecting the highly non-linear nature of the credit risk model. Zero-Coupon Bond - Definition, How It Works, Formula Zero-coupon bonds are the only type of fixed-income investments that are not subject to investment risk - they do not involve periodic coupon payments. Interest rate risk is the risk that an investor's bond will decline in value due to fluctuations in the interest rate. Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk ... I am looking for the equations or papers showing the risk-neutral pricing for zero-coupon bonds including default risk. I already tried Googling and searching SSRN and Jstor. bond zero-coupon risk-neutral. Share. Improve this question. Follow asked Apr 4, 2020 at 17:02. Jake Freeman Jake Freeman. 158 4 4 ...

How Do Zero Coupon Bonds Work? - SmartAsset Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Interest Rate Risk: Zero-coupon bonds that are sold before maturity are subject to interest rates risk. This is because the value of these bonds is inversely proportional to interest rates. Hence, if interest rates rise, the value of these bonds declines in the secondary market. Additionally, issuers have the option of redeeming the bond before ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Reinvestment Risk Definition - Investopedia Reinvestment risk is the risk that future coupons from a bond will not be reinvested at the prevailing interest rate from when the bond was initially purchased. Reinvestment risk is more likely ... Zero-Coupon Bond - Definition, How It Works, Formula A Zero-Coupon Bond also called a pure discount bond or deep discount bond is a debt instrument that does not make any interest payment during the bond's tenure. These bonds are ... The semi-annual coupon payments on coupon bonds reduce the risk and the wait time for the cash flow of the coupon bond as opposed to the zero discount bonds. Hence ... Zero-Coupon Bonds and Taxes - Investopedia The zero-coupon bond has no such cushion, faces higher risk, and makes more money if the issuer survives. Zero-Coupon Bonds and Taxes Zero-coupon bonds may also appeal to investors looking to pass ... Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Investment Problem Set Bond Valuation - Investment Problem Set #4 Bond ... a. What is the price per $100 face value of a two-year, zero-coupon, risk-free bond? b. What is the price per $100 face value of a four-year, zero-coupon, risk-free bond? c. What is the risk-free interest rate for a five-year maturity? Suppose a 10-year, $1000 bond with an 8% coupon rate and semiannual coupons is trading for a price of $1034. a.

Zero-coupon bonds news and analysis articles - Risk.net Latest Zero-coupon bonds articles on risk management, derivatives and complex finance

What Does It Mean if a Bond Has a Zero Coupon Rate? Zero Coupon Bonds. A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Since a zero-coupon bond does not have this risk, the YTM will differ accordingly. What Is Yield to Maturity? YTM is the total return a bond investor will expect if it is held to maturity.

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

The Allure Of Zero Coupon Municipal Bonds: A Low Risk Investment With ... The La Mesa bond is a zero coupon bond that pays no coupon i.e. no income each year. In exchange, you can buy one La Mesa bond for only $73.573, a $26.427 discount to par value. When it matures on 8/1/2026, you get $100 for each share you buy, which comes out to a yield to maturity of 3.2%.

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "39 zero coupon bonds risk"