39 zero coupon bond benefits

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The...

What Is a Zero-Coupon Bond? | The Motley Fool Also known as accrual bonds, zero-coupon bonds are debt securities that are sold at a deep discount for a price far below their face value. The reason? Unlike traditional bonds, zero-coupon bonds...

Zero coupon bond benefits

Zero Coupon Bonds Explained (With Examples) - Fervent | Finance Courses ... The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires. What are the advantages and disadvantages of zero-coupon bond? Answer (1 of 8): Zero coupon bonds require you to report implied interest every year on "phantom income" which you do not get until the bond matures. This seems like a bad idea to me The Pros and Cons of Zero-Coupon Bonds - Financial Web One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this ...

Zero coupon bond benefits. Zero Coupon Bond - Explained - The Business Professor, LLC Calculating the Price of a Bond. Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay ... What are the benefits to the issuers of zero-coupon bonds? Answer: The biggest advantage of a zero-coupon bond is its predictability. If you do not sell the bond prior to maturity, you do not have to worry about market ups and downs since you know what your investment will be worth at a particular future date. Hey dears, We have the most profitable stoc... Pros and Cons of Zero-Coupon Bonds | Kiplinger These bonds don't make regular interest payments. Instead, they're sold at a big discount to face value; when they mature, you collect the full amount. Their big advantage is that you know how ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ... How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. ... Zero coupon bonds don't offer the same benefits. Those bonds are issued at a deep discount and repay the par value at maturity. There is no coupon payment, hence the name. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-Coupon vs Traditional Coupon Bonds Unlike zero-coupon bonds, traditional coupon bonds with regular interest payments come with the following benefits: Source of Recurring Income for Bondholder Interest Payments Derisk the Lending (i.e. Raises "Floor" on Maximum Potential Loss) Consistent, Timely Interest Payments Confirms Credit Health Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Mr. Tee is looking to purchase a zero-coupon bond that has a face value of $50 and has 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used: Zero Coupon Bond Funds: What Are They? - The Balance Zero coupon bond funds don't get much press, but they can be valuable investment tools if used properly. The purchaser of the bond usually receives a steep discount, so it can result in substantial gains when they receive the full face value (also known as the par value) at maturity. 1 Some zero coupon bonds do not start as zero coupon bonds. Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example While normal bondholders receive interest payments on a regular basis (usually twice a year or annually), zero-coupon bondholders never receive interest payments. Instead, they receive a single...

Definition, Understanding, and Why zero coupon bond is Important? No reinvestment risk: Other coupon bonds don't let investors to a bond's cash flow at the same rate as the ...

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Following are the advantages of zero coupon bonds Significant returns on maturity These bonds are deep discount bonds that offer significant returns on maturity. Additionally, a bondholder can exit the bond by selling in the secondary market (stock market), in case the interest rates decline sharply. Fixed interest

Zero-Coupon Bond - The Investors Book Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

How to Invest in Zero-Coupon Bonds - US News Money "Consequentially, zero-coupon bonds are especially appropriate when investors wish to lock in a rate of return and be assured of a specific accumulation at a given future date," he says. Experts...

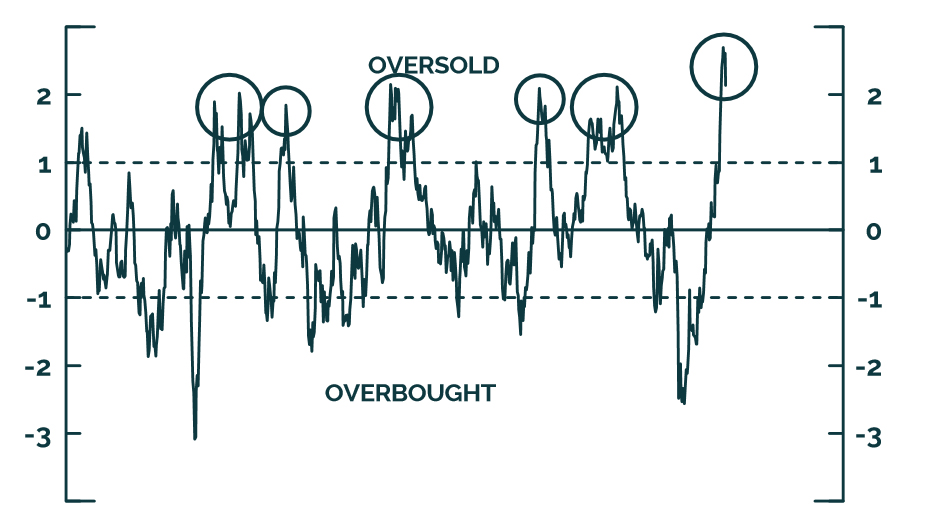

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Benefits and Drawbacks of Zero Coupon Bonds. Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. · Zeros-coupon ...

Zero-Coupon Bonds - Accounting Hub Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

The ABCs of Zero Coupon Bonds | Benefit & Financial Strategies LLC As with any investment, a zero coupon bond's appropriateness hinges on your individual needs and circumstances. Understanding some of the basic concepts may help you better assess whether they might have a place in your portfolio. 1. The market value of a bond will fluctuate with changes in interest rates.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Easy to Integrate into Financial Plans: Zero-coupon bonds are useful for investors who want a fixed nominal value in the distant future. For instance, people who are planning for their kids' education or marriage can set aside a sum of money right now which will grow and mature into a bigger lump sum at a later stage.

The Pros and Cons of Zero-Coupon Bonds - Financial Web One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this ...

What are the advantages and disadvantages of zero-coupon bond? Answer (1 of 8): Zero coupon bonds require you to report implied interest every year on "phantom income" which you do not get until the bond matures. This seems like a bad idea to me

Zero Coupon Bonds Explained (With Examples) - Fervent | Finance Courses ... The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires.

Post a Comment for "39 zero coupon bond benefits"