45 step up coupon bonds

Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond. Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Do EE and E bonds obtain a step-up basis when inherited ... These bonds do not get a step-up in basis. The recipient must pay an income tax on all interest earned on them from inception to the redemption. (As one of the attorney's mentioned, they are income in respect of decedent and there is no step up in basis for these items.) Hope this helps. LEGAL DISCLAIMER Mr. Fromm is licensed to practice law in PA.

Step up coupon bonds

Step-Up Bond Explained - moneyland.ch The term of a step-up bond is normally made up of a number of sub-terms. These are typically 1 year each. The interest rate used for coupons increases every ... What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to... Step-Up Coupon Securities financial definition of Step-Up ... A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change.

Step up coupon bonds. Types of bonds based on cash flows - Fixed Income ... A step-up coupon bond is a bond, either fixed or variable, whose spread increases incrementally over the life of the bond. Bonds with step-up coupons offer protection against rising market interest rates. It is because when market interest rates increase, the bond's coupon rates also increase thereby limiting any decrease in bond value. What is a Step-Up Bond? - Accounting Hub A step-up bond comes with a lower interest rate initially. Its interest rate steps up after a specific period as described by the issuer. The interest rate of this bond can increase over specified intervals and up to a specified extent. It can be a single increase in the interest rate and several hikes depending on the terms of the bond. Protecting investors from interest-rate risk with step-up ... The step-up bonds may have a single interest rate rise or multiple interest rate rises. However, the increases of the bond's coupon rates and their step-up dates are predefined by the issuer at the start. Some step-up bonds allow for an adjustment of the interest rate to the inflation rate. Step Up Bonds: Pros and Cons - Management Study Guide Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period.

Accounting for Step-Up Bond | Example | Advantage ... Multi Step-up Bond. Multi Step-up bond is the step-up bond in which the coupon rate increases more than one before the maturity date. Advantage of Step Up Bond. High return for investors: Investors will receive more return by investing in step-up bonds, the interest rate will keep increasing over time. If compared to normal bonds, the step-up ... Step-Up Bond - ClearTax A step-up bond is a security that has a coupon rate which increases with time. A step-up bond typically performs better than any other fixed-rate investment in a rising rate market. The Securities and Exchange Commission (SEC) regulates the step-up bonds. Stepped coupon bond - Financial Dictionary stepped coupon bond. A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Step-Up Bonds - eFinanceManagement Apr 25, 2022 · Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate “steps up” over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Describe Different Types of Bonds | CFA Level 1 - AnalystPrep FRNs generally have quarterly coupons. Step-up coupon bonds, either fixed or floating, have coupons that increase by specified margins at specified dates. Such bonds provide protection against rising interest rates. Credit-linked bonds have coupons that change in line with the bond's credit rating. Deferred Coupon Bonds: Definition, How It Works, Types and ... Step-Up Bonds These bonds do not make coupon payments until a certain period. For instance, a bond can start interest payments after 5 years with a 10 year maturity period. Toggle Notes Toggle notes pay increased interest rates after a certain period. Investors expect higher interest rates with a deferred payment condition. Step-Up Coupon Bond - Harbourfront Technologies Feb 05, 2021 · A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases. What Is a Step-up Bond? - The Balance But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work

Are step-up bonds good protection against rising rates? These are bonds where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series too. These are also called as a dual coupon or multiple coupon bonds. These are just the opposite of Step-Up Bonds. These are bonds where the coupon usually steps down after a certain period.

All the 21 Types of Bonds | General Features and Valuation ... Step-Up Bonds. The step-up bonds are where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series. Such bonds are usually issued by companies where revenues/ profits are expected to grow in a phased manner. These are also called dual coupon or multiple coupon bonds.

Step-Ups - Types of Fixed Income Bonds | Raymond James Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period.

Step-Up Coupon Bond | Derivative Valuation, Risk ... Step-up coupon bonds follow most of the characteristics associated with conventional bonds. Most bonds come with a coupon rate, which dictates the interest payments that investors will receive. For example, a bond with a face value of $1,000 and a coupon rate of 5% will always generate $50 in interest payments.

What are Step-up Bonds? Example, Types, Advantages, and ... For example, a lender pays buys a fixed-income bond for $1,000 from a company that offers a coupon rate of 4% with a maturity of 5 years. It means, each year the lender will get an interest payment of $40. After the five years are over, the company will pay back $1,000 to the lender, which is the face value of the bond and the amount the lender pai...

Step-Up Bond Definition - Investopedia Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases in the coupon...

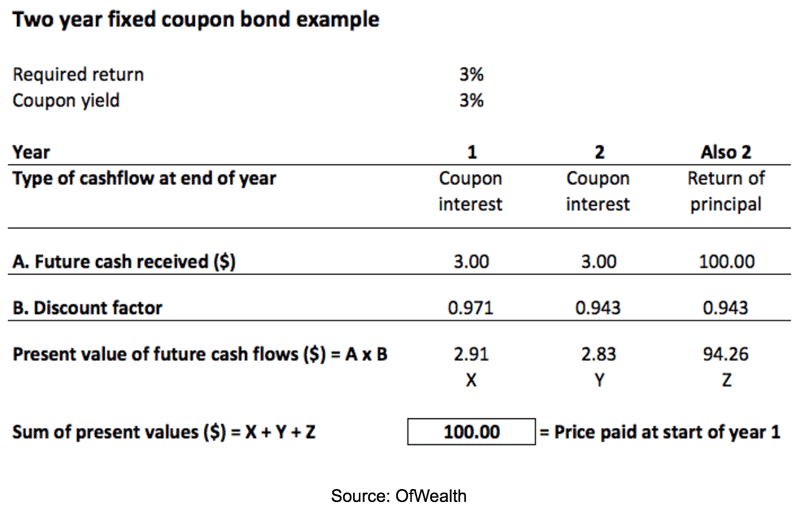

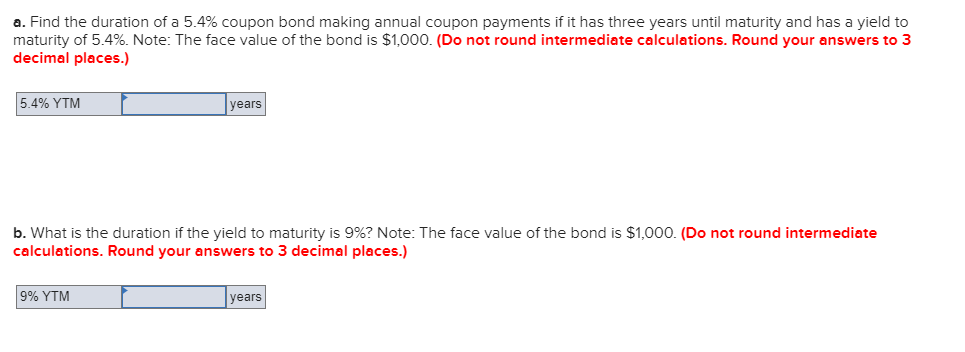

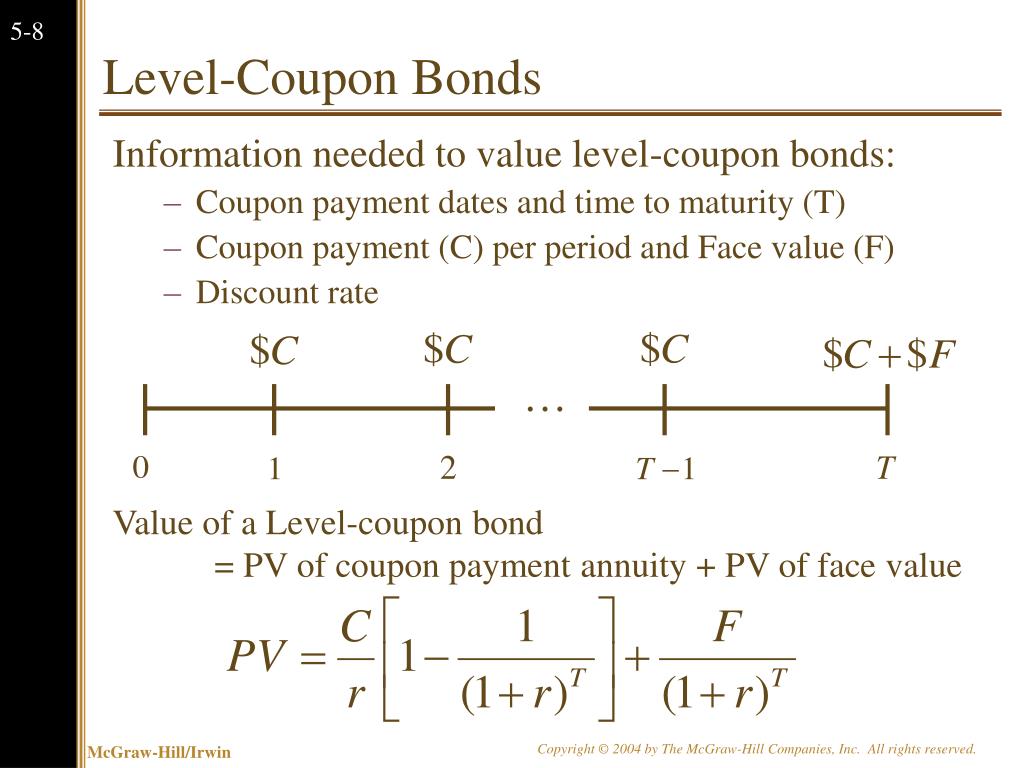

How to calculate the yield to maturity for a step-up ... 1 - Knowing the maturity, coupon rate, and yield are sufficient to calculate the bond price. 2 - First, you have to find the PV of all remaining coupons using this rather complicated-looking formula: PV==P* ( ( (1 + R)^N - 1)* ( (1 + R)^-N)* R^-1), where P==coupon rate, R=="asked" yield, N==Number of coupon periods.

Step-Up Bonds Definition & Example | InvestingAnswers A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ.

CH 7 Step up bonds.docx - Introduction to Step-up Bonds ... Introduction to Step-up Bonds: At the most basic level, step-up bonds have couponpayments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on eachanniversary date that the coupon resets or continuously after an initial non-call period.

PDF Understanding Callable Step-up Investment Products Tri Step-Up A tri step-up bond has three coupons over the life of the investment, if it is not called. This is an example of a 15-year tri step-up certificate of deposit. The coupon rate is 4.00 percent in year one, increases to 5.00 percent in year two and finally increases to 7.00 percent in years three to

Novartis stirs debate with first social-linked step-up ... Because the European Central Bank's purchase programmes only allow it to buy very plain bonds, it cannot purchase notes with step-up coupons. That rules out both the Enel and Novartis euro deals.

Step-Up Coupon Securities financial definition of Step-Up ... A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change.

What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to...

Raymond James Financial | Services and Products | Bond Basics | Types of Income | Step-Up Bonds

Step-Up Bond Explained - moneyland.ch The term of a step-up bond is normally made up of a number of sub-terms. These are typically 1 year each. The interest rate used for coupons increases every ...

Post a Comment for "45 step up coupon bonds"